The Impact of Nigerian Tax Reforms and Their Implications for Business Owners

Most Nigerian business owners have one thing in common, which is that they want to grow, sell more, and sleep peacefully at night without worrying about government wahala. But for years, the word “tax” has sounded more like a threat than a tool. Complicated systems, confusing rates, and too many overlapping taxes left many entrepreneurs wondering if the system was ever designed with them in mind. Whether you were selling fabrics in Lagos, running a tech startup in Abuja, or managing a provision store in Enugu, tax often felt like punishment for trying to succeed.

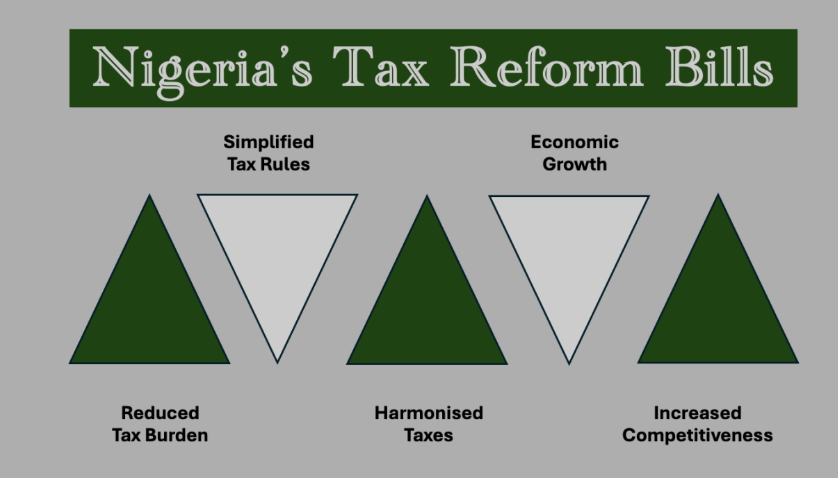

The Nigerian government introduced a bold wave of tax reforms that promise to change the situation, not just for big corporations, but especially for small and medium-sized businesses that form the heartbeat of the country’s economy. These reforms weren’t just a few tweaks to the tax code; they were a complete redesign meant to simplify how taxes work, cut down costs for struggling businesses, and bring more fairness into a system that has long favored the privileged.

Now, tax isn’t just about payment. It’s about possibility. The reforms are helping everyday business owners keep more money in their hands, access better government support, and finally be recognized as part of the formal economy without feeling crushed by it. It’s about understanding your rights, your obligations, and how to build your business in a country that’s finally learning to support its entrepreneurs.

But what do these reforms mean in practice? How does a reduction or exemption affect your day-to-day operations? What’s changed about VAT, income tax, or digital filing, and how does that impact your pricing, planning, or profit margins?

Let’s explore this together, not as policy experts, but as real people who just want to do honest business and grow with confidence in a system that works.

What is Taxation?

Taxation is one of those things that affects everyone, whether you notice it or not. It’s not just a government policy or a line on your receipt; it’s the engine that keeps a country running. It’s the system through which people and businesses contribute a portion of their income or earnings to the government, so it can build the roads we drive on, train the doctors who treat us, power the schools our children attend, and protect the systems that keep life moving.

But beyond this, taxation is about shared responsibility. It’s about saying, “We all benefit from this country, so we all play a part in keeping it going.” When done right, it’s fair and balanced. It considers who’s able to give more and protects those who can’t. It encourages business growth while making sure the basic needs of society are met.

In Nigeria, the concept of taxation is evolving. For a long time, many people felt disconnected from it, either because the system was confusing, unfair, or simply didn’t reflect their reality. But that’s changing. With reforms and clearer policies, taxation is slowly becoming less about fear or punishment and more about partnership and progress.

At its heart, taxation isn’t just about taking, but it’s about building. It’s about the government earning trust by using tax money transparently and wisely. And it’s about citizens and business owners understanding that their contributions matter, not just in paperwork, but in the everyday lives of millions of people.

Overview of Tax Reforms in Nigeria

Imagine paying for something simple, like a carton of milk or a haircut, and not realizing a small percentage of that money is going to the government. That’s tax. Now, imagine a system where the way those taxes are collected, calculated, and even spent is so outdated or unfair that it ends up draining business owners instead of helping them thrive. That’s where tax reform comes in.

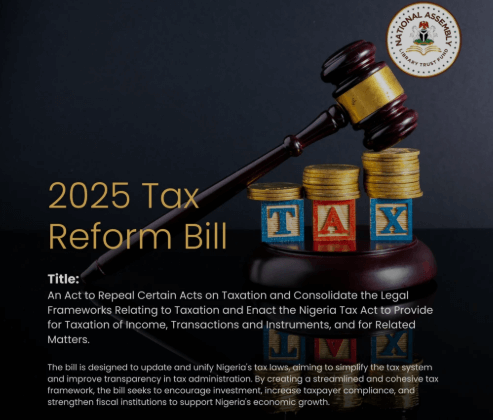

Tax reforms are changes made to the laws and systems that control how taxes work, who pays what, when, and how. These aren’t just adjustments to figures on paper, but they shape the real-life experiences of businesses, big or small. They decide if a business owner gets to reinvest in their business or spends sleepless nights calculating confusing levies. So, when President Tinubu signed the new Nigeria Tax Act, Tax Administration Act, Revenue Service Act, and Joint Revenue Board Act into law in 2025, it wasn’t just a political event; it was a fresh start for millions of entrepreneurs who’d been waiting for fairness, structure, and relief.

Now, let’s talk about the Tax-to-GDP ratio. It’s just another way of measuring how well a country is collecting taxes based on the size of its economy. Nigeria, with a tax-to-GDP ratio of just 10.8%, was underperforming. Compare that to other African countries collecting 15% to 20%, and you will see the gap. Not because Nigerians don’t want to pay taxes, but because the system has long made it hard, unclear, or even intimidating for people to do the right thing. This reform is especially focused on supporting the real engine of Nigeria’s economy, like small businesses. When we say SMEs or MSMEs, we’re talking about everyone from the tailor down the street to the logistics startup trying to survive Lagos traffic. These businesses provide jobs, feed families, and drive innovation, and they’ve often done it all without proper support or inclusion in formal financial systems.

Then there’s VAT, Value Added Tax. You’ve probably seen it on your receipts. It’s the tax added to the price of goods and services. But here’s what’s changing: the government now says some essential items, like basic foodstuffs, are zero-rated. That means no VAT will be charged on them. For the business owner, that’s fewer calculations and better affordability for customers. For the customer, that’s more power in their pocket. So when we talk about tax reforms, we’re not just talking about numbers, but we’re talking about real changes that touch every part of business life. It’s about finally having a system that understands your daily activities, rewards your honesty, and helps you grow instead of holding you back.

Key Tax-Related Laws

Understanding Nigeria’s tax system can feel like navigating a maze, especially for everyday business owners who just want to stay compliant without getting lost in legal jargon. But at the center of it all are a few key laws that lay the foundation for how taxes are applied, collected, and managed across different sectors. These laws don’t just apply to large corporations; they touch everyone from small-scale traders to oil giants. Here’s a breakdown of what each one means in everyday business terms:

Companies Income Tax Act (CITA)

This is the big one for businesses. CITA is the law that tells you how much tax a registered company in Nigeria has to pay on its profits. Whether you're running a logistics startup, a consulting firm, or an e-commerce store, if your business is officially registered with CAC and making profits, this law applies to you.

It covers how to calculate your taxable income, when to file, what qualifies as an allowable business expense, and even how tax exemptions or incentives work, most especially for small businesses and startups. CITA has seen updates over time to make it fairer and more efficient, especially for smaller businesses that were once overwhelmed by unrealistic tax expectations.

Value Added Tax (VAT) Act

Every time you buy something, a product or a service, there’s usually an extra charge added to the price. That’s VAT. This Act regulates how VAT is charged, collected, and remitted to the government. The VAT Act has undergone significant changes recently. It outlines which goods and services should be taxed, at what rate, and which ones are exempt or zero-rated, like basic food items, baby products, or medical supplies. It also explains how businesses should register for VAT, issue VAT-inclusive invoices, and file monthly returns. For business owners, e-commerce platforms, and even freelancers, understanding VAT laws means pricing your products correctly and staying on the government’s good side.

Personal Income Tax Act (PITA)

This law governs how individuals are taxed, including employees, freelancers, business owners who are not incorporated, and anyone earning income in Nigeria. If you earn a salary, run a business under your name, or offer services and collect payment directly, PITA applies to you.

It sets out income tax rates, what counts as taxable income, and how taxes are deducted, e.g., PAYE (Pay As You Earn) for salaried workers. It also includes tax reliefs and allowances, things that can reduce your tax burden if you qualify. With reforms under this Act, the goal has been to widen the tax net without punishing low-income earners, and to encourage voluntary compliance through easier processes and digital tools.

Petroleum Industry Act (PIA)

This law is more industry-specific but still massively important for Nigeria’s economy. The PIA regulates how businesses in the oil and gas sector are taxed, licensed, and operated. Oil has long been Nigeria’s largest source of revenue, and the old system was plagued by inefficiencies, corruption, and investor uncertainty.

The PIA was designed to fix that. It combines regulatory reform, taxation, and community benefit rules under one umbrella to make the sector more transparent and investment-friendly. For companies involved in oil exploration, refining, or gas supply, the PIA determines how they pay taxes, royalties, and other levies, while ensuring that host communities benefit directly.

Together, these laws form the core of Nigeria’s taxation framework. They don’t just dictate who pays what; they also shape the way businesses operate, grow, and contribute to national development. By understanding them, business owners, freelancers, SMEs, and even corporations can better plan their finances, avoid penalties, and take advantage of available tax incentives and reforms designed to support long-term business growth.

Key Features of the Tax Reforms

Taxes Lifted for Small Businesses

Small businesses in Nigeria just got a major win. If your company makes between ₦50 million and ₦100 million a year (around $32,000), you're now fully exempt from paying Companies Income Tax (CIT), Capital Gains Tax (CGT), and the Development Levy. This change affects about 90–96% of businesses in the country, meaning most small and medium-sized enterprises no longer have to worry about these taxes. It’s a smart move to ease the burden on local entrepreneurs, encourage growth, and make it easier to stay compliant without breaking the bank.

Tax Cut for Bigger Firms

Starting in 2026, Nigeria’s corporate tax rate will be lighter for companies. It’s dropping in stages from 30%, down to 27.5% in 2025, and finally to 25% in 2026. This gradual cut is meant to boost business confidence, attract more investments, and ease the pressure on companies, especially those trying to grow or recover in a challenging economy. It’s a step toward making Nigeria more competitive across Africa when it comes to doing business.

Personal Income Tax Made Fairer

If you earn ₦800,000 or less per year, which is around ₦66,000 per month, you now pay zero personal income tax with no deductions. For those earning more, taxes are now structured in progressive brackets, meaning the more you earn, the higher the rate you pay, up to a maximum of 25%. This makes the system fairer and lighter on low-income earners, while asking higher earners to contribute more.

Essential VTAs Now Exempted

The VAT rate stays at 7.5%, but there's good news: essential items like food, fuel, medicines, rent, electricity, and education are now zero-rated. This means you won’t pay VAT on these basic needs, helping to lower living costs for everyone, especially low-income families, while keeping the tax system fair and focused on non-essential spending.

Institutional Overhaul & Digital Progress

The FIRS is now called the Nigeria Revenue Service (NRS), and it’s not just a name change. A new Tax Ombudsman and Tax Appeal Tribunal have been introduced to handle complaints and disputes fairly. From July 2025, the system goes digital with electronic invoicing and real-time filing, making tax processes faster, more transparent, and harder to evade. Everything will also be unified across federal, state, and local levels, so taxpayers deal with one streamlined system instead of scattered offices.

The Importance of Tax Reform for Businesses

Simplifies Life for Business Owners

Business owners now have it easier with less paperwork, fewer trips to tax offices, and one digital portal for all filings. This simplification makes tax compliance smoother, more transparent, and business-friendly, while helping business owners focus more on growth than bureaucracy.

Boosts the Formal Economy

Tax exemptions now make it easier and safer for informal traders to register their businesses. By coming into the formal system, they can access loans, grants, insurance, and legal protections, turning side hustles into stable, scalable businesses with real growth potential.

Fairer and More Progressive

With the new tax reforms, wealthy individuals and large companies now shoulder a bigger share of taxes, while small businesses and low-income earners get relief. This shift creates a fairer system, reducing pressure on everyday Nigerians and allowing smaller businesses to thrive without being overtaxed.

Growth & Investment Signal

The goal of these tax cuts and new reforms is to increase Nigeria’s tax-to-GDP ratio to around 18%. With more effective tax collection, the government can fund better roads, hospitals, schools, and public services, creating real benefits for citizens and a stronger economy overall.

Impact on Businesses

Tax reforms have brought both relief and challenges for Nigerian businesses:

- SMEs face higher costs due to the VAT increase from 5% to 7.5%, making daily operations more expensive, especially for those serving end consumers.

- Corporate tax changes offer relief to small businesses (under ₦25 million turnover) are now fully exempt, and medium ones (₦25–₦100 million) pay 20% instead of 30%. But larger companies still face a 30% rate, one of the highest in Africa.

- The digital economy is now taxed too; foreign companies like Google and Netflix must pay tax on Nigerian earnings, which could lead to higher prices for customers.

- Yet, many businesses still deal with multiple taxes from federal, state, and local authorities, causing confusion and higher compliance costs despite ongoing reforms.

Impact on Individuals

Tax reforms have had noticeable effects on everyday Nigerians:

- VAT increase from 5% to 7.5% raised prices on goods and services, making basic needs like food, transport, and healthcare more expensive.

- Personal Income Tax now exempts minimum wage earners, giving low-income workers some relief, though middle and high-income earners still face heavy deductions.

- Businesses, squeezed by higher costs, are cutting back on hiring or reducing wages, which affects employment and job security.

- In real estate, new stamp duties on rent and property deals have driven up housing costs, especially in cities like Lagos and Abuja, making accommodation harder to afford for many.

Smart Strategies for Business Owners

Navigating Nigeria’s evolving tax system can feel overwhelming, especially if you're just trying to keep your business afloat. But the truth is, getting ahead of the situation doesn't require perfection; it just needs smart, practical steps that protect your business and open new doors.

If you're operating informally, even as an ordinary trader or market seller, registering your business and getting a Tax Identification Number (TIN) isn’t just about ticking boxes. It’s your key to unlocking real benefits, like access to grants, business loans, and legal protection. Being visible in the system also shields you from surprise penalties and unnecessary stress when policies change.

Now is also the time to upgrade the way you track your business. Whether you’re selling online or offline, digital invoicing and tax tools can save you time, reduce errors, and keep you ready for tax season without panic. There are platforms, training hubs, and even tax officers willing to guide you through the setup, especially now that the government is pushing for simplified systems.

When it comes to VAT, understanding what items are zero-rated, like basic food and fuel, can help you strategize your pricing in a way that keeps customers loyal and your profit margins stable. Many small businesses get caught off guard when they don’t factor VAT relief into their pricing plans, so don’t let that be you.

Regulations change fast, and silence isn’t bliss; it’s risky. Following credible tax news, attending local workshops, or simply staying in the loop through social media or WhatsApp groups can keep you informed and prepared. You don’t need to become a tax expert, but being aware of deadlines and updates can save your business money and stress.

There are business communities and networks, like SMEDAN, PEBEC, or your local chamber of commerce, that exist to help you. They offer real-time advice, fight for policies that protect small businesses, and often connect you with free resources you didn’t know existed.

Smart businesses don’t just react to tax laws; they adapt early, stay informed, and lean into systems that work. You can do the same, without losing your rhythm or your customers.

Quick Stats Insight on Nigerian Tax Reforms

Nigeria’s economy is powered by the silent engines of everyday businesses like micro, small, and medium-sized businesses (MSMEs). These are the corner shops, the online business owners, the tailors, bakers, mechanics, logistics riders, and service providers we all rely on daily. They’re not just filling gaps; they’re holding the economy up.

Right now, there are about 39 million MSMEs across Nigeria, making up 96% of all businesses in the country. Together, they contribute nearly half of Nigeria’s GDP. That means when these small businesses thrive, the entire nation feels the ripple effect, from growth in the markets to jobs created in local communities.

About 84% of jobs in Nigeria are created by these businesses. That’s millions of families who rely on MSMEs for income, stability, and survival. So when we talk about supporting small businesses, we’re not just talking economics, we’re talking about protecting livelihoods and futures.

But while these businesses give so much to the economy, the country’s tax-to-GDP ratio sits at just 10.8%, one of the lowest in the world. The government aims to raise it to around 18%, hoping that better tax collection can fund roads, hospitals, and education. But the question is: how do we get there without crushing the same small businesses that keep the economy alive?

And we can’t ignore the backdrop that around 56% of Nigerians, that’s about 129 million people, still live below the poverty line. It’s not just about taxes and percentages, but it’s about creating a fair, inclusive system where growth is shared, and no one is left behind. Every number here represents real people, real struggles, and real potential. That’s why these reforms matter is not just for compliance, but for the future of every business, every home, and every dream in Nigeria.

Conclusion

What’s unfolding in Nigeria right now isn’t just a tax shift; it’s a turning point. For years, the conversation around taxation felt like something far removed from the day-to-day realities of shopkeepers, service providers, and young entrepreneurs trying to get by or scale up. But today, that conversation has come home.

The latest tax reforms are nudging Nigeria into a new chapter, one that has the power to build a more balanced, inclusive economy if it's handled with care. Yes, there are still hurdles that are overlapping taxes, unclear rules, and the weight that bigger companies carry. But look closer, and you’ll see a real effort to lighten the load for the small business owners, the local food vendor, the home-based fashion brand, the one-person logistics startup. These reforms are designed to pull them out of the shadows and give them a fair shot at growing legally, safely, and profitably.

What this means is opportunity. Digital filing systems can remove the friction of queues and paperwork. Tax exemptions for lower earners mean more money left in the hands of those who need it most. And simplified policies, when well communicated, can help informal businesses become recognized, funded, and protected.

But no reform works in isolation. The future depends on how this change is rolled out, how transparent it is, how much support is offered, and how many people are truly included in the process. If done right, this isn’t just a policy win for the government, but it’s a win for communities, for creators, for job seekers, and for dreamers whose businesses are still scribbled in notebooks or run from phone screens.

This moment is not perfect, but it’s promising. The path ahead could unlock a new kind of progress, one where tax doesn't feel like a threat, but a tool that builds bridges between effort and reward. Whether you’re selling handmade skincare, coding an app, or managing three employees in a kiosk, this system should be working for you. And that’s why now, more than ever, it's time to stay informed, stay equipped, and stay included, because this isn’t just reform. It’s a redefinition of how Nigeria builds wealth, from the grassroots up.